Why Most Budgets Fail (And How To Fix Yours)

Apr 21, 2025

Let’s be honest—if budgeting feels like a never-ending cycle of good intentions and broken rules, you’re not alone. Millions of people create budgets each month only to abandon them a few weeks (or days) later. But here’s the truth: it’s not your willpower that’s broken. It’s your budgeting strategy.

Let’s dig into why most budgets fail—and more importantly, how to fix yours so it actually works for real life.

❌ 1. Most Budgets Are Too Restrictive

The #1 reason budgets fail? They’re unrealistic.

People often try to go “cold turkey” on spending, slashing everything from takeout to gym memberships to $5 coffees. That might sound smart, but here’s the problem: if your budget feels like punishment, you won’t stick to it.

✅ Fix It: Make Your Budget Reflect Your Real Life

Your budget should include money for unexpected expenses, not just survival. Life is going to happen, and you're going to have unexpected expenses. The key is to plan for them intentionally instead of pretending they don’t exist.

❌ 2. You’re Not Tracking Where Your Money Actually Goes

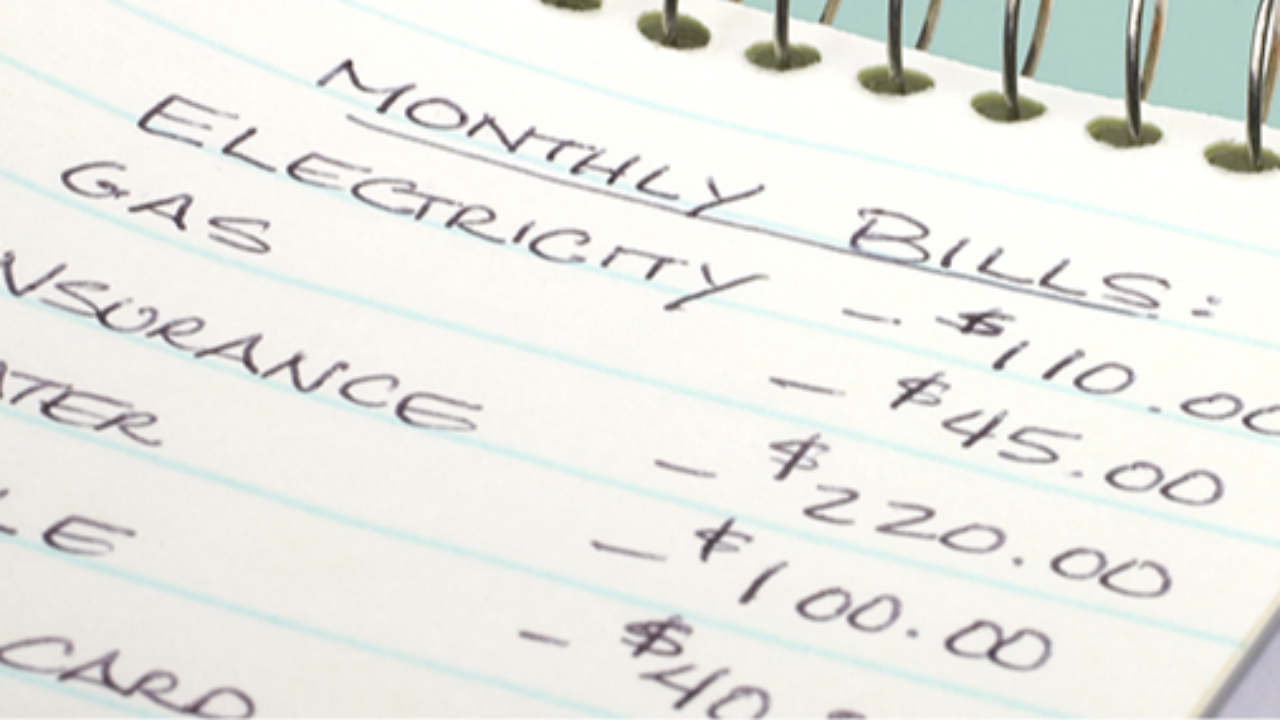

Budgets fail when they’re based on guesses instead of facts. If you don’t know exactly how much you spend on groceries, gas, or subscriptions, your budget will always be off—and frustrating.

✅ Fix It: Track Every Dollar

Before you build your budget, track your expenses for 30 days. Use an app like EveryDollar or YNAB, or even a simple spreadsheet. The clarity you gain will help you build a budget that works with your habits, not against them.

❌ 3. You’re Budgeting the Wrong Way for Irregular Income

If you work on commission, freelance, or have fluctuating hours, a traditional monthly budget won’t cut it. You can’t base your spending plan on numbers that change every week.

✅ Fix It: Use a Paycheck-Based or Tiered Budget

Build a “survival budget” based on your lowest expected income, and upgrade it when you earn more. Better yet, plan your budget by paycheck rather than by month. That way, your spending and saving are always in sync with what’s actually coming in.

❌ 4. You’re Not Giving Every Dollar a Job

Too many people create vague budgets like “spend less on food” or “save more this month.” But those kinds of plans don’t hold up in real life.

✅ Fix It: Use Zero-Based Budgeting

With zero-based budgeting, you assign every single dollar a purpose until your income minus expenses equals zero. That means you’re planning for savings, debt payoff, bills, and fun all in advance. It gives your money direction—and that leads to progress.

❌ 5. There’s No Accountability or Review Process

Even the best budget can fail if it gets ignored after it’s written. Budgeting is like going to the gym—you won’t see results if you only show up once.

✅ Fix It: Set a Weekly “Money Check-In”

Spend 10–15 minutes each week reviewing your spending, adjusting your budget, and planning for the week ahead. If you’re married or sharing finances, make it a “money date” and talk through things together. This is where clarity and teamwork create momentum.

💡 Final Thoughts

Budgeting isn’t about perfection. It’s about progress, intention, and peace of mind. If your budget has failed you in the past, don’t give up—just try a better approach.

Start small. Track your expenses. Build a zero-based plan. Make space for real life. And most importantly, keep going.

If you need help building a budget that actually works, I offer 1-on-1 coaching for individuals and couples who are ready to take control of their finances. Click here to book a free intro session, and let’s build your plan together.